A tale of gold, tariffs, labor and Japanese fountain pens

I have written in the past about my love for analog things, more specifically fountain pens. I own over 300 such fountain pens from makers across the world - from one man shops to large corporations. Of the countries that produce excellent fountain pens, the one I enjoy the most from is Japan. Japan has long been a purveyor of excellent stationery and when it comes to fountain pens, three big Japanese companies produce some of the very best - Sailor, Pilot and Platinum. So imagine my shock and that of the broader pen community when all three of them announced massive price increases to some of their best selling pens. My favorite pen podcast covered this in extensive detail - hear here and here. But then, I am not just an analog things guy, I am also an AI guy. So what better than digging into this topic with Gemini 3.0. I asked Gemini to breakdown the situation, identify potential reasons and most important of all, suggest some mitigation paths. So without further ado, here we go. I have tried to make this interesting but if you choose to skip my tl;dr and want to either read the full report, or an interactive summary, you can do it. I promise I wont feel bad :)

The Big Picture

In January 2026, Japan's leading pen manufacturers Pilot, Sailor, and Platinum implemented dramatic price increases ranging from 10% to 100%, marking the industry's most significant pricing shift since 1985. The catalyst was a perfect storm: soaring gold prices above $4,500/oz and silver past $88/oz, persistent structural challenges in Japan including severe labor shortages, elevated energy costs, and a weak Yen, increasing shipping costs and tariffs roiling the math in unpredictable ways. This confluence of macroeconomic shocks forced a complete repricing across domestic and export portfolios for an industry that had maintained relative price stability for decades.

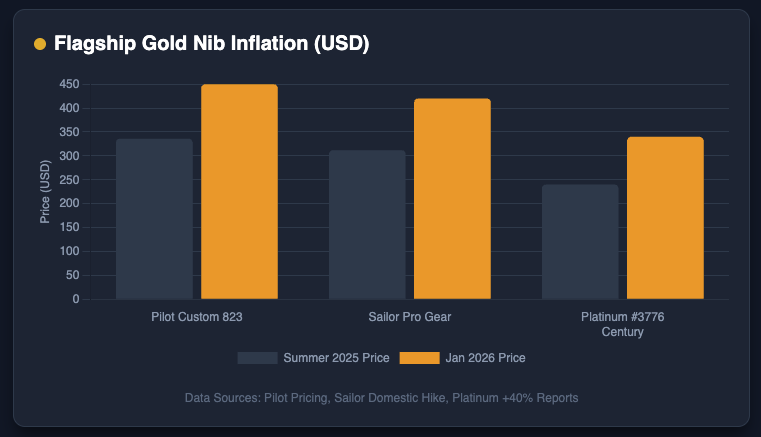

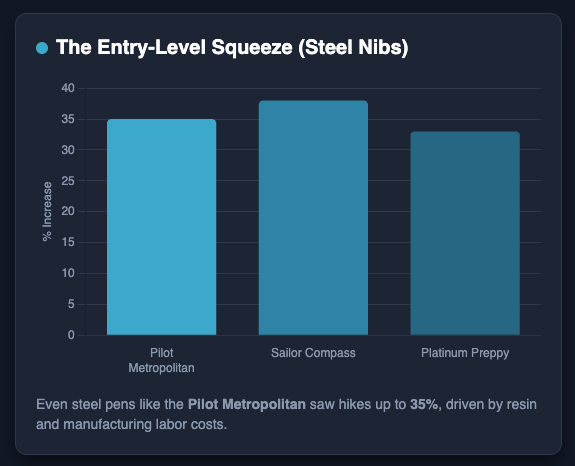

So how big was this shift? Here are some examples. I chose three popular gold nib pens and three entry level pens for comparison - the plot below shows before and after.

Why?

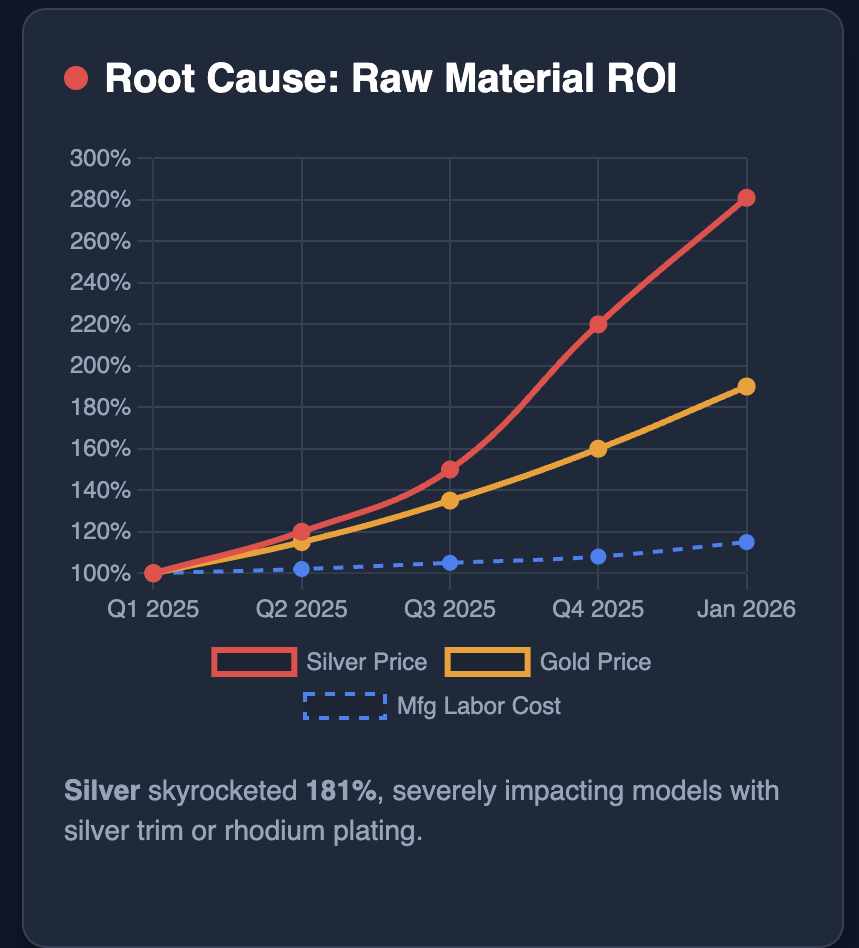

There is not one universal reason for this but a confluence of things happening all at once. Gold prices have been shooting up over the past year. Many of these gold pens are largely plastic or metal bodies with a fancy nib, a good feed and an ink holder. Any increase in gold prices will impact them quite a bit. Labor costs have also been going up over time and coupled with tariffs, the cost of doing business is much higher than it used to be. Per Gemini, the chart below represents increasing costs across all these individual contributors.

Ultimately, given Japanese companies are reticent to raise prices on anything, this might be them capturing all of these individual bumps into one big jump.

Impact to the Business

Customers of Japanese will now see dramatic increases to pen costs across all segments as shown in the charts above. And given the persistent inflation, sticky unemployment and flat wage growth, it is unlikely that there is much of a disposable income to absorb these huge price increases. This could potentially have a positive impact on US makers of fountain pens with steel nibs in the near term. A Esterbrook Estie that retails for ~$175 or a US-made anodized Aluminum pens from Schon Dsgn that sell for $150 or a Franklin-Christoph starting at $175 or a Spoke Icon that sells for $120 and is customizable, or the many dozen solo maker pens could all become much more appealing. Even Italian made pens from Leonardo or German pens from Kaweco might benefit from these Japanese pen price increases. Ultimately though, in a niche category like fountain pens, less choice means fewer enthusiasts. When there is a lot of variety, you could argue, it will attract more people to the hobby and thus expose them to more makers in the long run. To that effect, this price increase might put a dent on the overall fountain pen business, not just for Japanese pens.

Some Ideas

I asked Gemini for some ideas to help solve this problem. It suggested a few - taking a stronger stand against the gray market, simplifying SKUs and subsidizing the lower end. While each of these ideas will help a bit, I cant see it solving the problem over the long term. I wanted to throw in one more crazy idea - in my mind, there are a few opportunities worth exploring.

The Fat Middle - While we talked a lot about the low end and the gold nib premium category, there will now be a growing appetite for pens that fall in the $75-$150 spectrum. This is opportunity for both the Japanese and other makers to build a set of new steel nib pens that cater to this segment. Pilot can grow their Prera business. Platinum can build something like the Procyon (sorry, that one is a bad pen). Sailor can grow the Tuzu audience with more premium barrels but at budget+ pricing. There is opportunity here - ask TWSBI, Lamy and Kaweco for their secret sauce.

New Materials for nibs - This one is a little out there. Should nib makers start exploring 10K gold for entry level premium gold nibs. 10K jewelry is not uncommon. Why not nibs?

Grow the accessory pie - Fountain pens are just one piece of the analog writing story. Inks and paper, not to mention the very many other interesting things coming out of Japan (have you see the JetPen videos :)) could be a big opportunity. There are dollars here waiting to be spent on stationery. If its not a fancy fountain pen, it could be something else.

Ultimately, this is a really sad situation for all of us, fountain pen afficionados. And I dont expect to see this change anytime soon. Prices only go in one direction - up. Even for someone like me who has reasonable disposable income, it feels wrong to spend $500 on a pen that used to be $250 just over a year or so ago. While I make my peace with not indulging in as many pens as I used to, I hope their stationery makers use the time to come up with other ways to keep me hooked and engaged in this lovely hobby.